Assault on the Fed

by u/Ihaveeatenfoliage

Late Sunday night, Chair of the Federal Reserve Jerome Powell released an unprecedented statement, just 13 hours before markets open Monday morning. The Department of Justice, without a doubt under President Trump’s direct influence, served the Federal Reserve with grand jury subpoenas.The entire financial world is being shaken by the previously unthinkable news that the independence of the Federal Reserve is being attacked directly at its core. In the past, Donald Trump has been openly hostile in speeches towards Powell, but with this move, Trump has taken tangible steps to punish Chair Jerome Powell for not lowering interest rates as Trump has demanded. Although this move is unlikely to sway the current Federal Reserve Chair in the remaining four months of his term, this assault sets a precedent for Powell’s successor that Trump will commit impeachable offenses to make good on his demand that the next Fed Chair listens to his advice in setting interest rates.

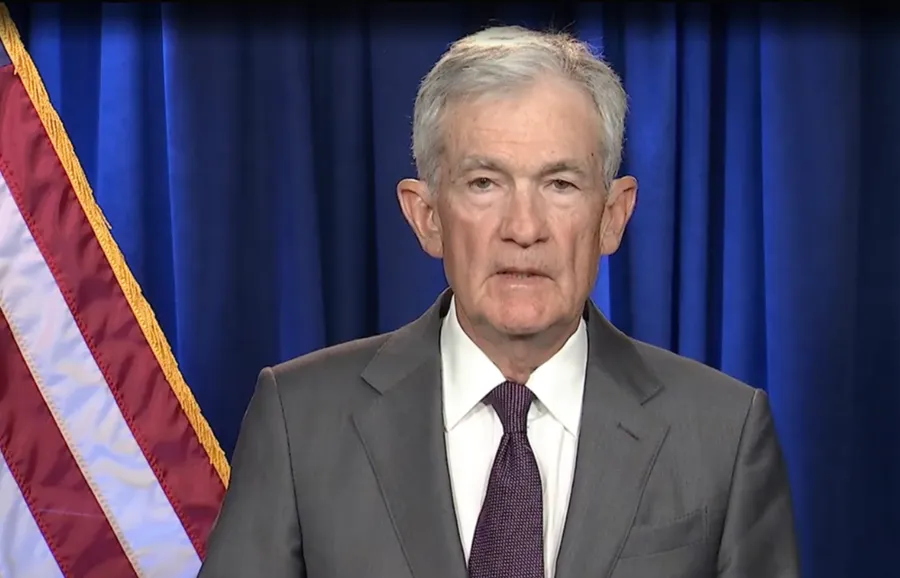

Fed chair Jerome Powell discloses in a video statement on Jan. 11 that he is the target of federal grand jury subpoenas.U.S. Federal Reserve.

If Jerome Powell follows through on his pledge to continue to do the job he was confirmed by the Senate to perform, and if Senate Republicans push back aggressively on this overreach that neither they nor their donors support, then it is possible that a greater disaster can be avoided.

However, this blatant move against Fed independence is the equivalent of the United States lowering the Danish flag on our base in Greenland and proclaiming our base to be United States territory. It is a move that even if retracted has the potential for permanent damage, where the TACO refrain “Trump always chickens out” provides cold comfort, as there’s no denying that an irrevocable step has been taken.

The Intangible Value of Federal Reserve Credibility

Independence in the conduct of monetary policy is at the core of advanced modern economies. And it can be too easily forgotten by those who have only known its benefits. If the Federal Reserve lost its independence, its hard-earned credibility would quickly dissipate. The costs to the economy would be incalculable: Higher inflation, lower standards of living, and a currency that risks losing its reserve status.

- Governor Kevin Warsh in “An Ode to Independence” on March 26, 2010 (https://www.federalreserve.gov/newsevents/speech/warsh20100326a.htm)

…monetary policy-makers will generally find it advantageous to commit publicly to following policies that will produce low inflation. If the policymakers' statements are believed (that is, if they are credible), then the public will expect inflation to be low, and demands for wage and price increases should accordingly be moderate. In a virtuous circle, this cooperative behavior by the public makes the central bank's commitment to low inflation easier to fulfill. In contrast, if the public is skeptical of the central bank's commitment to low inflation (for example, if it believes that the central bank may give in to the temptation to overstimulate the economy for the sake of short-term employment gains), then the public's inflation expectations will be higher than they otherwise would be. Expectations of high inflation lead to more-aggressive wage and price demands, which make achieving and maintaining low inflation more difficult and costly (in terms of lost output and employment) for the central bank.

- Governor Ben Bernanke Remarks on October 8, 2004 (https://www.federalreserve.gov/boarddocs/speeches/2004/20041008/default.htm)

Inflation and the Interest Cost of U.S. Treasuries

While many commentators observe the impact of the swings in American interest payments on our federal deficit, the rate at which our national debt is eroded by inflation is less remarked upon.

If inflation in America runs higher, then the market interest rates will increase, increasing our government deficit. However, at the same time, the rate that our national debt is eroded by inflation also will increase, roughly canceling out the fiscal impact on the ledger. The true cost of inflation comes in the form of a tendency of slower real economic growth through a less stable economic environment. It is also very unpopular with the public at large

Instead, the real cost of borrowing in the long term is better approximated by stripping out inflation from the yield of Treasuries. To understand the real danger, we have to look beyond the headline interest rates and look at what investors demand to be paid over and above inflation. In fact, there is a special Treasury bond that does that, the TIPS or Treasury Inflation-Protected Security. See below the yield of the 10 year TIPS over the past 20 years.

These consistently modest real burdens of government borrowing are dependent upon the credibility of the Federal Reserve to keep inflation under control. While expected inflation rates may not materially damage the real cost of the U.S. debt, the risk for unexpected and uncontained inflation will see lenders demand higher returns than expected inflation to compensate them for the risk of serious loss if their dollars lose value.

Impeachable

The mandate given to the Federal Reserve by Congress is independence. Destroying that independence is an impeachable offense.

Call your representatives, whether Republican or Democrat. Reach out to your newspapers and let them know this story matters. Every day that this is not contained and reversed does potentially irreversible damage to the future of American prosperity.