Tourniquet Diplomacy: The Art of the Threat Pays Off

by u/Case_Newmark

President Trump, long struggling to clinch trade deals, is now emerging from his most productive phase of negotiations. Sitting in the humbly named DJT ballroom, Trump and Ursula von der Leyen announced a new tariff deal between the EU and the U.S., setting a new standard for Trump’s bullying tactics. The deal reads like negotiating with your best friend to shoot you in the stomach instead of the face.

European Commission President Ursula von der Leyen sits with U.S. President Donald Trump, after the announcement of a trade deal between the U.S. and EU, in Turnberry, Scotland, Britain, July 27, 2025. REUTERS/Evelyn Hockstein

When von der Leyen arrived in Scotland, she was tense. After losing a high-profile EU court ruling and narrowly surviving a vote of no confidence, many MEPs had made it clear. This was her last chance. After weeks of negotiators modifying and working out details, she finalized the specifics with Trump himself in the around 40 minute long meeting.

Trump himself had been skeptical of the talks beforehand. A month prior, he stated he had no intentions of making a deal with the EU. “Our discussions with them are going nowhere!” Trump posted on Truth Social. “I’m not looking for a deal. We’ve set the deal — it’s at 50%.”

But the President, not immune to flattery, changed his mind after taking a phone call from von der Leyen, his preferred method of communicating with diplomats and heads of state. Interpersonal relationships are what sway Donald the most, and Leyen played into it. After promising to move “swiftly and decisively”, Trump backed down and agreed to continue negotiations.

He entered the resort in a “bad mood”, saying there was a “50/50” chance that a deal could be reached. The initial combativeness put EU diplomats on edge. Von Der Leyen would have her work cut out for her.

She met the President at his personal golf resort in Turnberry. Despite the pressure, she had to wait until Trump had spent the day strolling the greens, hitting balls that caddies dropped, and then let him ramble to the press about how disgusting windmills are.

“The golf was beautiful,” Trump modestly told reporters. “Even though I own it, it’s probably the best course in the world. And I look over the horizon and I see nine windmills at the end of the 18th. I say, isn’t that a shame?”

In the end, though, Leyen managed to find a deal with him. According to her, the talks were “tough”. She later told reporters at Glasgow airport: “You saw the tension at the beginning. So we had to work hard to come to a common position.”

Trump came out of the meeting, declaring the deal to be “the biggest one of them all”.

Short on Details, Long on Concessions

Despite thoughts that von der Leyen may be more resistant to arm twisting than leaders who represent a single nation, the deal was never going to be more than stemming the bleeding. The EU was already gunning for a reduction from a 30% baseline tariff rate to a 15%. The recent U.S. deal with Japan gave the bullying tactics employed by the Trump administration legitimacy. The deal was finalized at a 15% baseline tariff rate, in exchange for a 550 billion dollar investment in the U.S., eerily similar to the EU’s deal.

A deal with the EU proved harder to reach than with other nations, reflecting the 27 member bloc’s economic influence. But even this was not enough to stop the Trump bullying tactics. Commerce Secretary Howard Lutnick told reporters of an investigation into the semiconductor industry, which could lead to new sectoral tariffs being imposed, expected in around two weeks.

The EU agreed to a baseline 15% tariff rate. Higher than the 10% imposed on April 2nd, and noticeably higher than the 1.2% prior to the Trump presidency. Still, it is lower than the 30% that were set to kick in on August 1st, which would have likely ignited a trade war.

The trading partners “seem to have avoided a self-destructive trade war for now in the biggest and deepest commercial and investment relationship the global economy knows,” said Jörn Fleck, senior director of the Atlantic Council’s Europe Center.

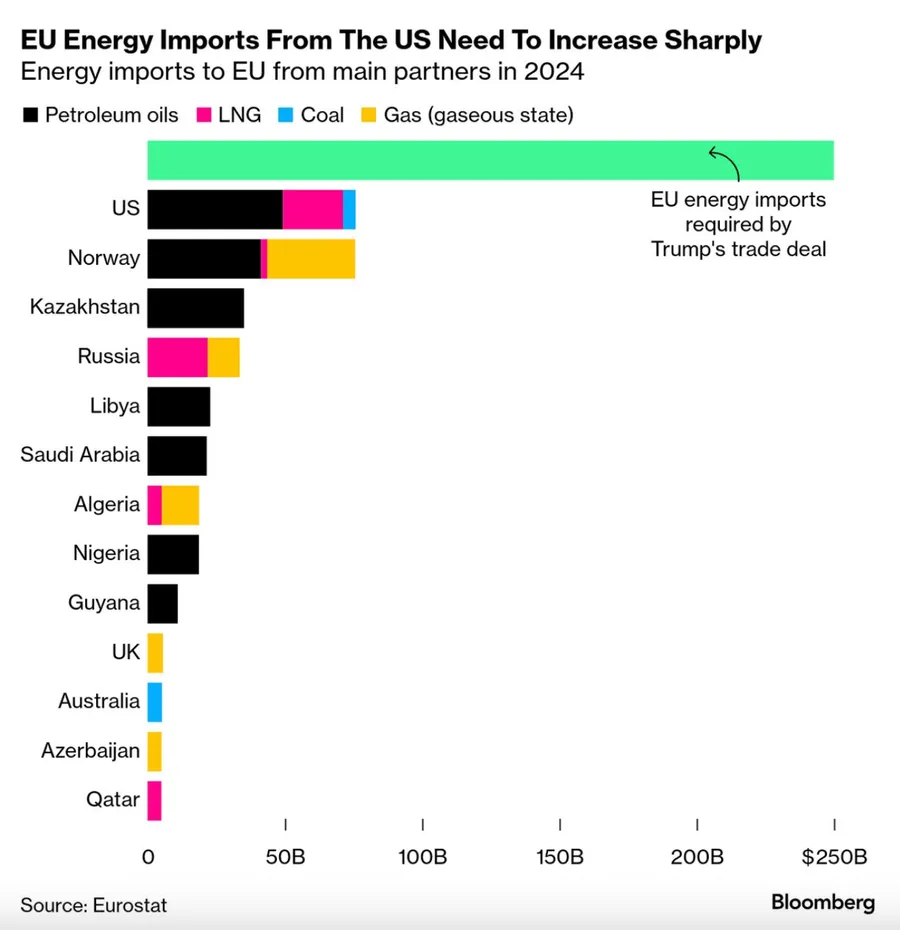

The EU has also agreed to increased FDI (Foreign Direct Investment), to the tune of 600 billion dollars. They also agreed to purchase 750 Billion in U.S. energy, something von der Leyen says will reduce energy dependence on Russia. According to Barbara C. Matthews, Nonresident senior fellow at the Atlantic Council’s GeoEconomics Center and former US Treasury attaché to the European Union, the energy investments can help deliver “stable baseload energy to power data centers and artificial intelligence technologies”. The agreement means a 250 billion a year investment until 2028.

This follows a common pattern in the deals. Increased FDI, U.S. energy purchases, and baseline tariffs. Most deals lack details, and don’t seem to target non-tariff trade barriers like value-added taxes and digital services taxes. The administration seems to be focusing solely on getting tariff wins; their extortion scheme is projected to make 90 billion in revenue so far. A drop in the bucket, paid for by American taxpayers.

Among the hardest hit are American automakers. The 15% tariff EU cars face is less than the 25% if the American manufacturers make their cars in Mexico.

The two trading partners also agreed to a 0 for 0 tariff rate on certain generic pharmaceuticals, chemicals, aircraft and aircraft parts, semiconductor equipment, certain agricultural products, natural resources, and critical raw materials. The specifics are unclear at this time. von der Leyen also acknowledged that Trump may ultimately place higher tariffs on drugs imported to the United States, undercutting the agreement.

Steely on Steel and Aluminum

Trump also said the 50% aluminum and steel tariffs would remain, which was a sticking point for EU negotiators. These tariffs are hugely impactful. Trump had already put in tariffs similar in 2018, where they imposed 25% tariffs on steel and 10% on aluminum imports from most trading partners. EU exports of steel to the U.S. immediately collapsed. By 2021 U.S. steel imports from the EU were still about 40–50% lower than before March 2018. By contrast, EU aluminum exports to the U.S. actually rose somewhat, as the analysis found EU aluminum volumes up ≈7% while values fell, implying a price drop.

The tariffs hit EU metal producers hard. EU steel output and employment have declined sharply. Industry figures report that EU crude steel production is down by ~31 million tonnes since 2018 (roughly a 20% drop).

Eurofer notes EU steel lost 10 million tonnes of capacity in 2024 alone (its highest annual loss ever). Around 18,000 steel jobs were cut in 2024, on top of ~90,000 lost since 2008.

Aluminum producers in Europe similarly report damage. While the EU metal association acknowledged that EU aluminum exports actually rose under the first round of tariffs, new U.S. tariff actions have skewed raw-material flows. In particular, high U.S. tariffs on fabricated aluminum have sent a surge of scrap shipments from Europe to the U.S., since scrap was not similarly taxed. European Aluminium reports that in Q1 2025 exports of aluminium scrap to the U.S. jumped 273% year-on-year. Two‑thirds of all aluminum scrap EU exports in 2024 were shipped in just the first three months of 2025, indicating an accelerating “scrap outflow” driven by U.S. tariffs. This threatens Europe’s recycling and semi-fabrication sectors, and experts have urged the EU to consider export fees on scrap to retain supply.

Even EU producers not directly losing U.S. export volume are hit by the disruption of supply chains and depressed prices.

Politically, the metal tariffs strained U.S.-EU relations. Allies have long bristled at the national-security justification. Even EU officials have called the U.S. measures “unjustified” and against WTO rules. The dispute has bled into other agendas. Despite talk of a “transatlantic climate club” for green steel, the two sides have sharply different visions. In practical terms, the tariffs have been a recurring irritant during NATO and G7 meetings, and have forced the EU to develop its own industrial strategy (new safeguard duties and energy subsidies) to stay competitive.

A New Transatlantic Relationship

“It’s going to bring a lot of unity and friendship. It’s going to work out really well,” Trump said of the deal.

The deal may have brought wary but hopeful headlines about renewed transatlantic unity, but in substance, it revealed a more sobering reality. The EU blinked. Faced with the threat of spiraling tariffs and a president visibly more comfortable wielding coercion than compromise, Brussels opted for damage control over defiance. The agreement underscores how even a powerful, 27-member bloc can find itself on the back foot when the cost of confrontation becomes too steep.

It’s tempting to frame the outcome as a diplomatic win for both sides, but that would require ignoring the asymmetry at its core. Trump got the number he wanted: a headline 15% tariff baseline, with promises of record-shattering foreign investment and energy purchases. Europe, meanwhile, avoided a deeper crisis, but at the cost of normalizing tactics that more closely resemble economic blackmail than traditional diplomacy. Who’s to say Trump won’t simply walk back these promises, as he has many times before? One good phone call from Russia or China, and he might throw it all away just as quickly as he decided to have a deal in the first place. Leyen herself acknowledged this threat.

Ursula von der Leyen at a press conference in Brussels, Belgium on 9 September 2024 Dursun Aydemiran/Anadolu/AFP

The implications go beyond this deal. With new investigations already announced and threats of sector-specific tariffs on the table, it’s clear that the art of the threat remains central to Trump’s negotiating strategy. The EU will need to decide whether it continues to play along in hopes of short-term stability, or whether it begins rethinking its structural vulnerability to U.S. pressure.

This episode may not mark a new transatlantic relationship so much as a reversion to an old, familiar one. A transactional and unbalanced relationship, defined more by leverage than by shared vision. The EU may have avoided a trade war, but at a cost that raises a fundamental question.

What, exactly, is being preserved?

Trump, luckily, focused on more pressing, serious issues.

“They’re killing us,” (referring to windmills), he told reporters at the family owned golf course. “They’re killing the beauty of our scenery, our valleys ... They’re made in China, almost all of them. When they start to rust and rot in eight years, you can’t really turn them off. You can’t bury them.”